VEND Token

Vendible is a cooperative network. Each member of the network must pledge to support the network. Members who stake VEND can take part in the governance of the network and increase their member rewards.

Vendible is a cooperative network. Each member of the network must pledge to support the network. Members who stake VEND can take part in the governance of the network and increase their member rewards.

As a cooperative network, where every participant is unique, Vendible strives to help create environments where people and businesses can flourish. Vendible will issue VEND, a utility and governance token that helps secure the network and rewards beneficial action to accomplish this.

Each participant on the network must stake VEND in proportion to their involvement with the network. Auditors or Vendible can slash a participant’s stake if they are a bad actor or abuse the system. Staking VEND happens during the creation and management of associated accounts.

Vendible believes it takes a tribe to compete successfully in today’s world. Vendible issues VEND to members through various published activities to incentivize support. Members manage a portion of these rewards as part of participation in governance, and, ideally, the members will take full ownership of these functions over time.

In a circular incentive model, Vendible shares a percentage of revenue generated through its operation with all members (whether they stake VEND or not). Members who stake VEND earn a bonus percentage of this reward.

There are no inflationary mechanisms connected to staking the VEND token. As VEND has a fixed supply, inflation through staking is not sustainable over time. The revenue share eliminates the need to inflate supply as stakers are rewarded with a mix of assets including BTC, ETH, MATIC, ALGO, VEND, etc. This means staking does not release additional supply into the ecosystem.

VEND is locked into every active associated account creating a deflationary action

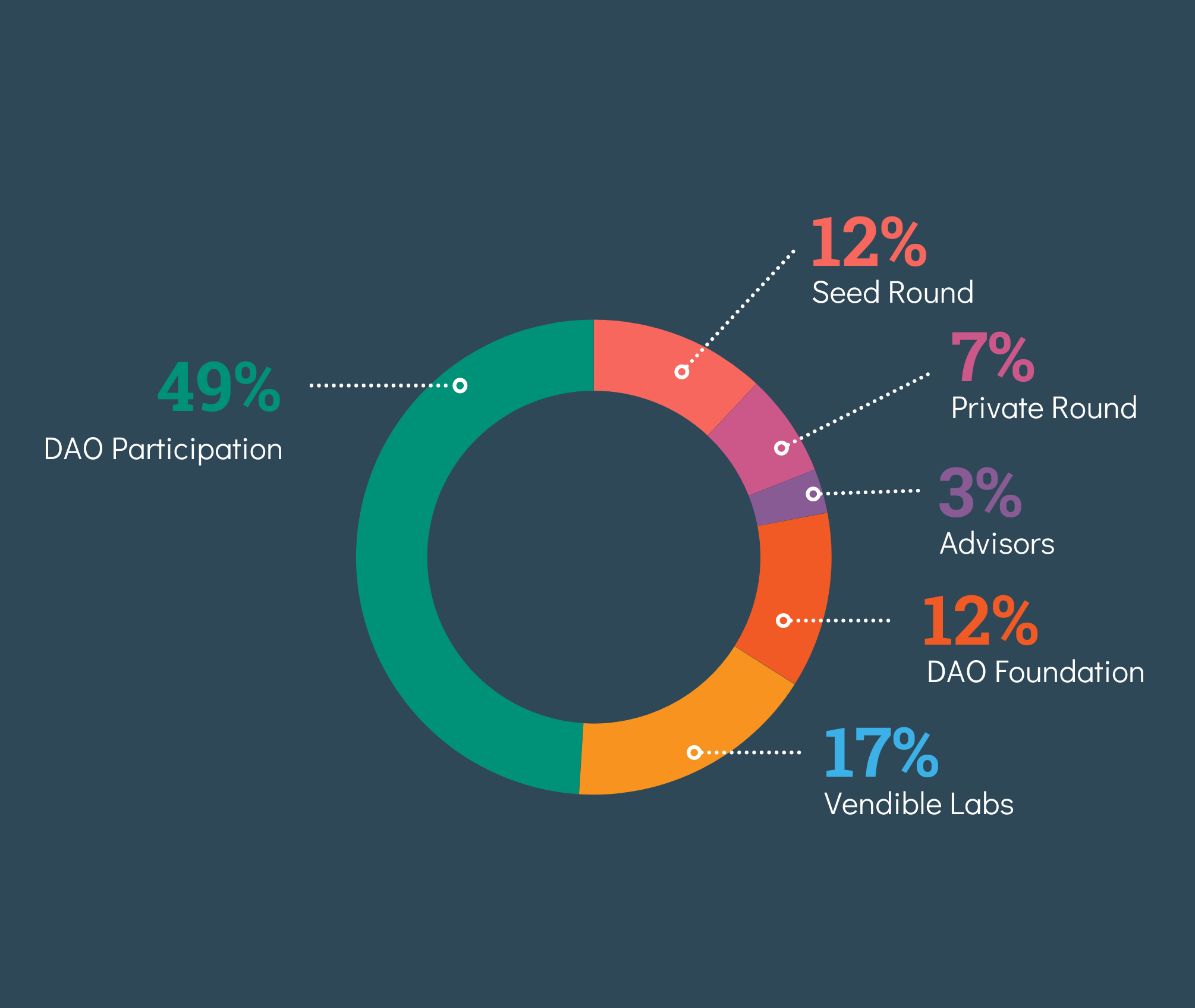

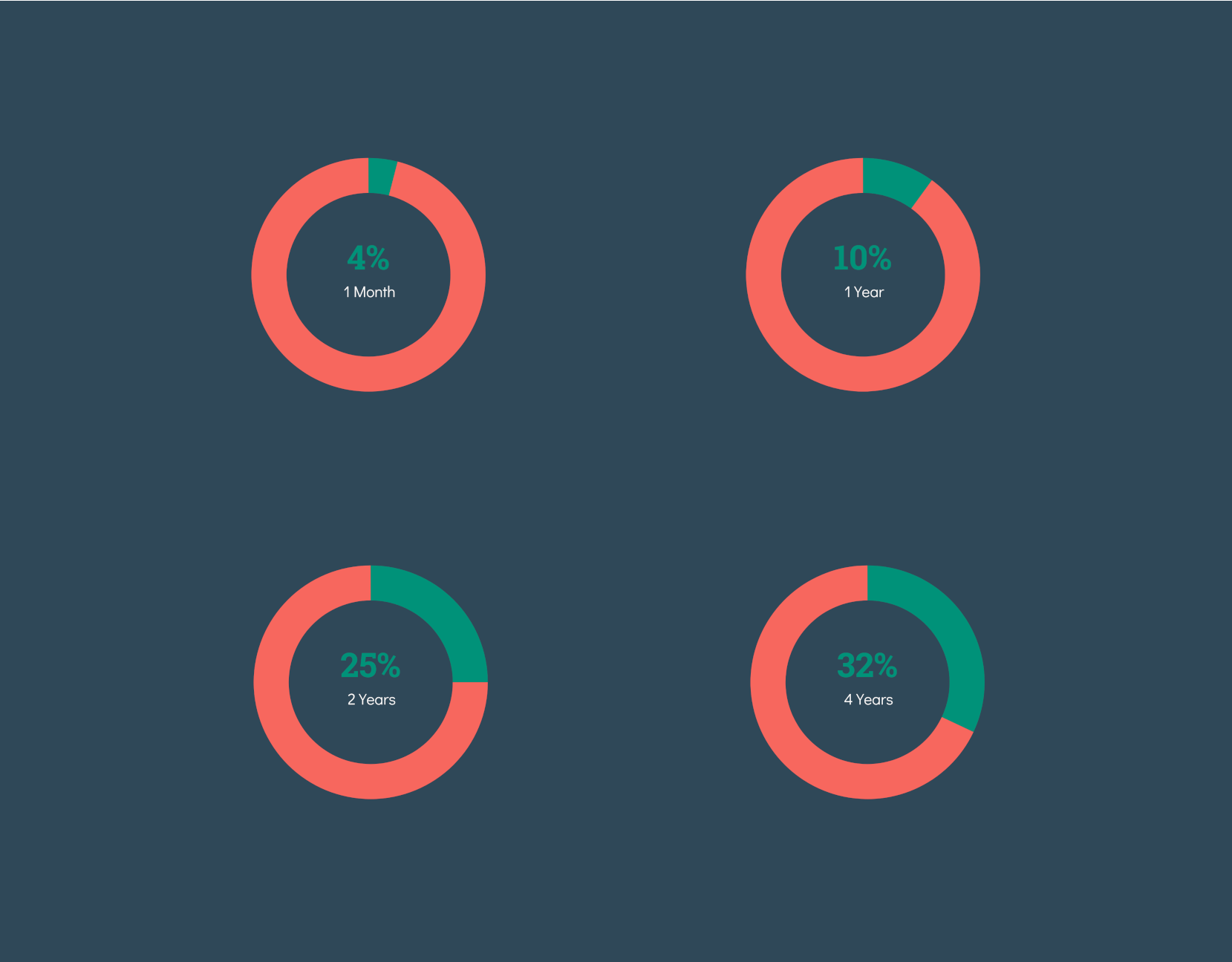

These charts show the estimated total supply of VEND in the ecosystem. This chart does not represent amount available for exchange as much of this supply is locked in Trustible subscriptions and other applications which create associated accounts. Additional supply is held by members to participate in governance to direct the DAO treasury and receive rewards in digital assets such as BTC, ETH, ALGO, etc.

Every participant in the network must stake VEND as a cooperative action to ensure long-term stability for Vendible. There are multiple entry points for staking.

Members stake VEND in Trustible when securing new private keys or connecting to applications. They can either participate when connecting their new associated account or allow another member to stake on their behalf. This is called the minimum committment and is our way of measuring an entities weight on the network.

Vendible adds VEND into each new member associated account. This minimum committmet will become part of a staking/slashing mechanism in a future anonymous repurtation system.

Members stake VEND to take a more active role in governance and help secure the network.

Certified developers stake VEND when creating associated accounts to manage users on their platform.

Data storage providers stake VEND for each associated account whose data store accesses their pledged availability.

Members who stake VEND can opt into governance. VEND governance includes oversight of the Vendible treasury and future accountability programs.

Stakers receive a bonus in the revenue share participation program.

A DAO Foundation will help guide the DAO towards greater decentralization over time.

You can read more about our tokenomics here.

Have more questions? Great!

Join in the conversation